Welcome to our annual CPE at the Ranch

Welcome to our annual CPE at the Ranch

Here you will find:

- 15 hours of IRS approved education hours

- 2 hours of ethics!

Limited Rooms Available So Book Early To Reserve Your Room

Our speaker

Our speaker

Michael Ferguson, CPA, CFP

Michael has thirty plus years experience in private practice – providing accounting, tax, and financial planning services to businesses and individuals. He previously practiced in South Atlanta, but is currently practicing in Guntersville, Alabama.

For the past sixteen years he has been a part of the instructor team for the Auburn University Fall Tax Seminar. He holds a Bachelor of Professional Accountancy degree from Mississippi State and is a registered provider with the NASBA.

AGENDA

Wednesday

10:00 – 11:30 a.m. GAATP Board Meeting (Board Members Only)

12:00 – 1:00 p.m. Registration

1:00- 2:40 p.m. New Legislation, IRS Rulings, Court Cases

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Familiarize attendees with latest rulings and cases impacting local practitioners.

2:40 – 3:00 p.m. Break

3:00 – 3:50 p.m. Individual Issues Introduction. The Not so Basic of the Basic 1040

Program Level: Basic to Intermediate Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: 1040 Preparation-Adding Value and Getting it Right. A review of the top of the form, including planning opportunities and pitfalls.

3:50- 5:30 p.m. Individual Issues. Let’s talk income

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Review the rules and highlighting planning opportunities in the first 15 income lines of form 1040

Evening – Dinner and Activities Provided

Thursday

7:00-8:00 a.m. Breakfast Included with Room Package

8:00- 9:40 a.m. Individual Issues. Empowering Your Clients’ Future

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Planning for Social security, Medicare Tax and benefits

9:40- 10:00 a.m. Break

10:00- 11:40 a.m. Individual Issues. Schedules 1, 2, 3 and Additional Planning Opportunities and Cautions.

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Review the rules and opportunities around the adjustments, credits and deductions found on schedules 1, 2, 3 and A

11:45 -12:45p.m. Lunch Provided

12:45 – 2:10 p.m. Annual Meeting

Officer Installation

2:10- 4:00 p.m. Ethics

Program Level: Beginner Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Participate in an interactive review of various ethical situations. Form simple to a bit more challenging.

Evening – Dinner and Activities Provided

Friday

7:00-8:00 a.m. Breakfast Included with Room Package

8:00- 9:40 a.m. Business Issues – S-Corp Update and Planning

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Various topics pertinent to S-corporations as well as planning opportunities.

9:40- 10:00 a.m. Break

10:00- 11:40 a.m. Tax Planning for 2025 and Beyond, Open Mic

Program Level: Intermediate to Advanced Program Prerequisites: None

Advance Preparation: None Delivery Method: Group-Live

CPE Hours: 2.0 IRS -Approved credit hrs.

Learning Objective: Planning opportunities for the coming years. Submit your questions; the gnarly will be presented for open discussion.

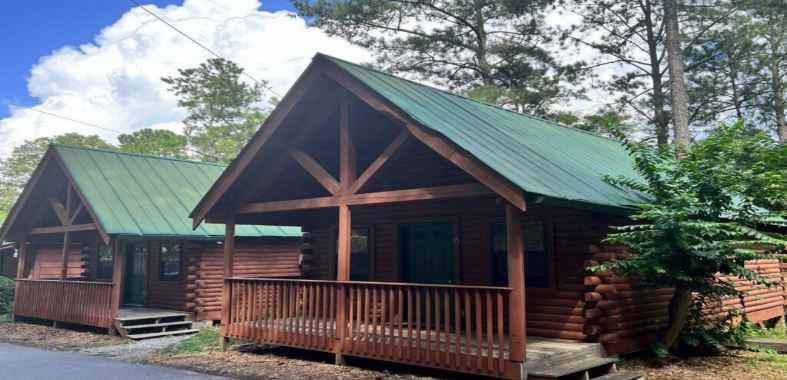

ROOM RESERVATION

- Includes 2 nights stay + 5 meals

- Single or Double Occupancy Rates

- Reservations can be made on the reservation form or call Rhonda at (770) 258-7480

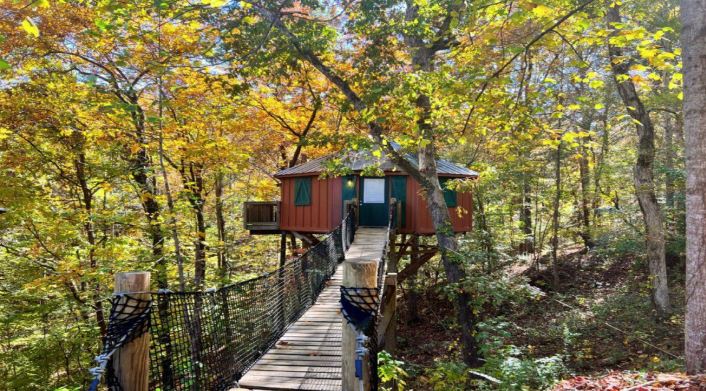

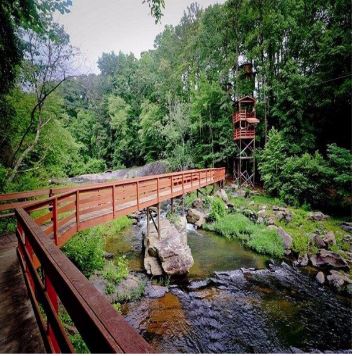

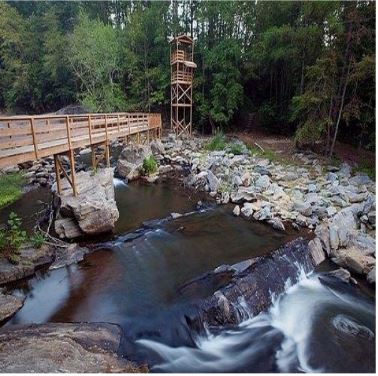

The Lodge at Banning Mills

2017 St. James Way Tallapoosa GA 30176 855-576-8431

Things to Do at Banning Mills

- Mini -Golf

- Hiking

- Zip line

- Eco-Spider Swincar tour

- Kayaking

- Climbing wall

- Horseback Riding

- Nature Show

- Pool Table

- Outdoor Pool

Please call (770) 258-7480 for info on the event or email us at: services@gaatp.org

GAATP Complaint Resolution Policy

Any and all complaints are handled on a case by case basis utilizing the resources of our Ethics and Grievance Committee. The complaint must be received in writing and signed by the complainant. All information and the exam process are held confidential. The findings and disposition shall be submitted to and must be approved by the Board of Governors. It is the effort of the Ethics and Grievance Committee to be fair and impartial basing its deliberations and/or findings on merits of the individual complaint.

IRS Approved Continuing Education is only mandatory for enrolled agents (EAs) and enrolled retirement plan agents (ERPAs). Participation in Continuing Education by all other federal tax return preparers is now voluntary.

GAATP Refund Policy

All requests for refund of seminar registration fees must be made in writing and are subject to a $75.00 service charge. If seminar registration fee is less than $75, service charge will be equal to half the registration fee. Requests made prior to fourteen (14) days of the event will be fully refunded less the service charge. Fourteen (14) days through forty-eight (48) hours of the event will receive half the registration fee subject to the charge. There will be no refund for failure to show (“No Shows.”)

Georgia Association of Accountants and Tax Professionals (GAATP) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org.